Section 179 Tax Savings Commercial Vehicles New Mexico

Maximize Savings With Section 179 Tax Benefits for Commercial Vehicles in New Mexico

At Melloy Ford in New Mexico, we understand how crucial it is for Albuquerque businesses in New Mexico to optimize their financial strategies. One powerful tool to help you save is the Section 179 Tax Deduction for commercial vehicles. This provision allows businesses in the Los Lunas and region to deduct the full or partial purchase cost of qualifying vehicles used for work, helping you invest back into your operations.

How Section 179 Works

How Section 179 Works

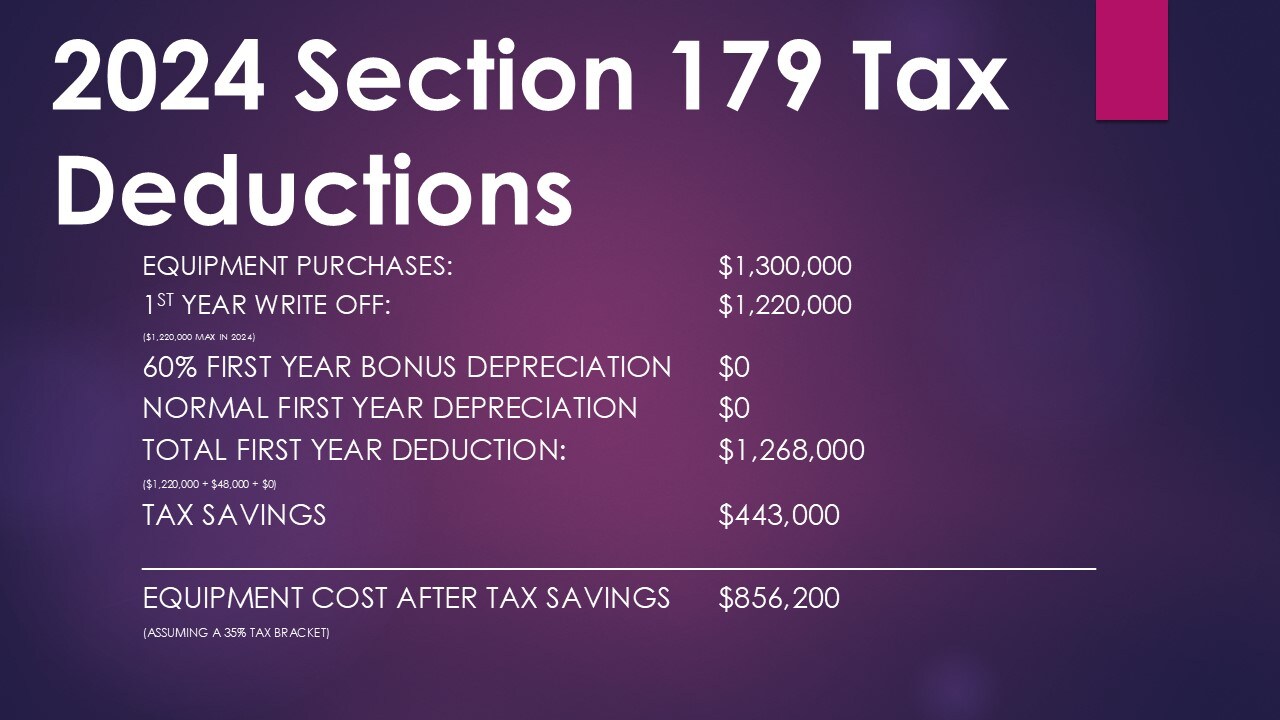

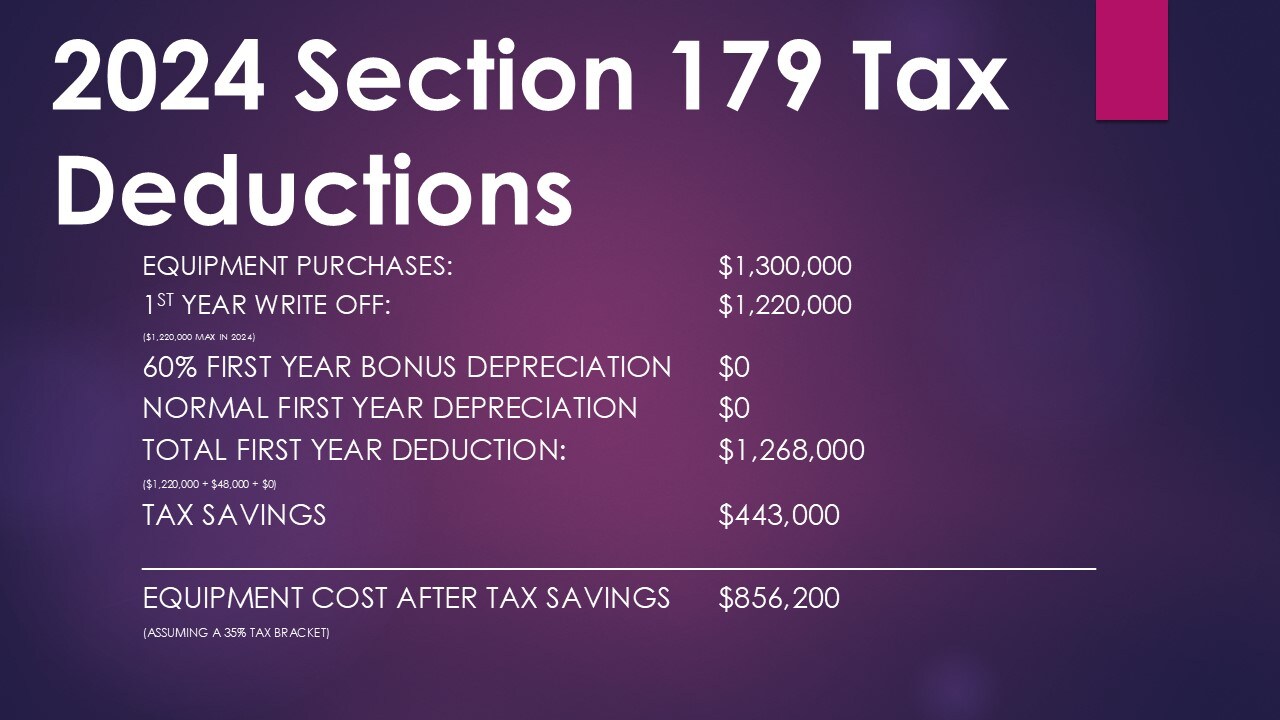

The Section 179 Deduction enables businesses in New Mexico to claim significant tax savings on vehicles purchased or leased and used for at least 50 percent business purposes during the tax year. This applies to both new and "new to you" vehicles. The deduction amount depends on the type of vehicle, its weight, and its intended use. Vehicles must be placed in service by the end of the tax year to qualify.

Full Deduction Vehicles

Certain vehicles, designed exclusively for business use, may qualify for a full deduction under Section 179. These include:

- Cargo vans with no seating behind the driver.

- Shuttle vans accommodating nine or more passengers.

- Special-use vehicles like ambulances or over-the-road tractor trailers.

Partial Deduction Vehicles

Heavy vehicles such as trucks and SUVs with a Gross Vehicle Weight Rating (GVWR) over 6,000 pounds are eligible for partial deductions. For example:

- Trucks with an eight-foot cargo bed may qualify for deductions proportional to business use.

- Heavy SUVs used primarily for work may claim up to $30,500 in deductions for 2024.

Important Considerations

For the Section 179 Deduction to apply:

- Vehicles must be titled in the business's name.

- They should be used for business at least 50 percent of the time.

- Deductions can only be claimed in the year the vehicle is placed in service.

Tailored Solutions at Melloy Ford

Whether you're looking for rugged work trucks or versatile SUVs, Melloy Ford offers a wide selection of vehicles that meet Section 179 requirements. Our team can help you identify qualifying models, secure specialized financing, and guide you through the deduction process.

Invest in your business with confidence-explore Melloy Ford's commercial inventory today and start saving with Section 179!